An Unbiased View of Medicare Graham

An Unbiased View of Medicare Graham

Blog Article

Medicare Graham Can Be Fun For Everyone

Table of ContentsAbout Medicare GrahamAll About Medicare GrahamRumored Buzz on Medicare GrahamThe Medicare Graham PDFsSome Known Questions About Medicare Graham.Medicare Graham Things To Know Before You Get ThisThe Single Strategy To Use For Medicare Graham

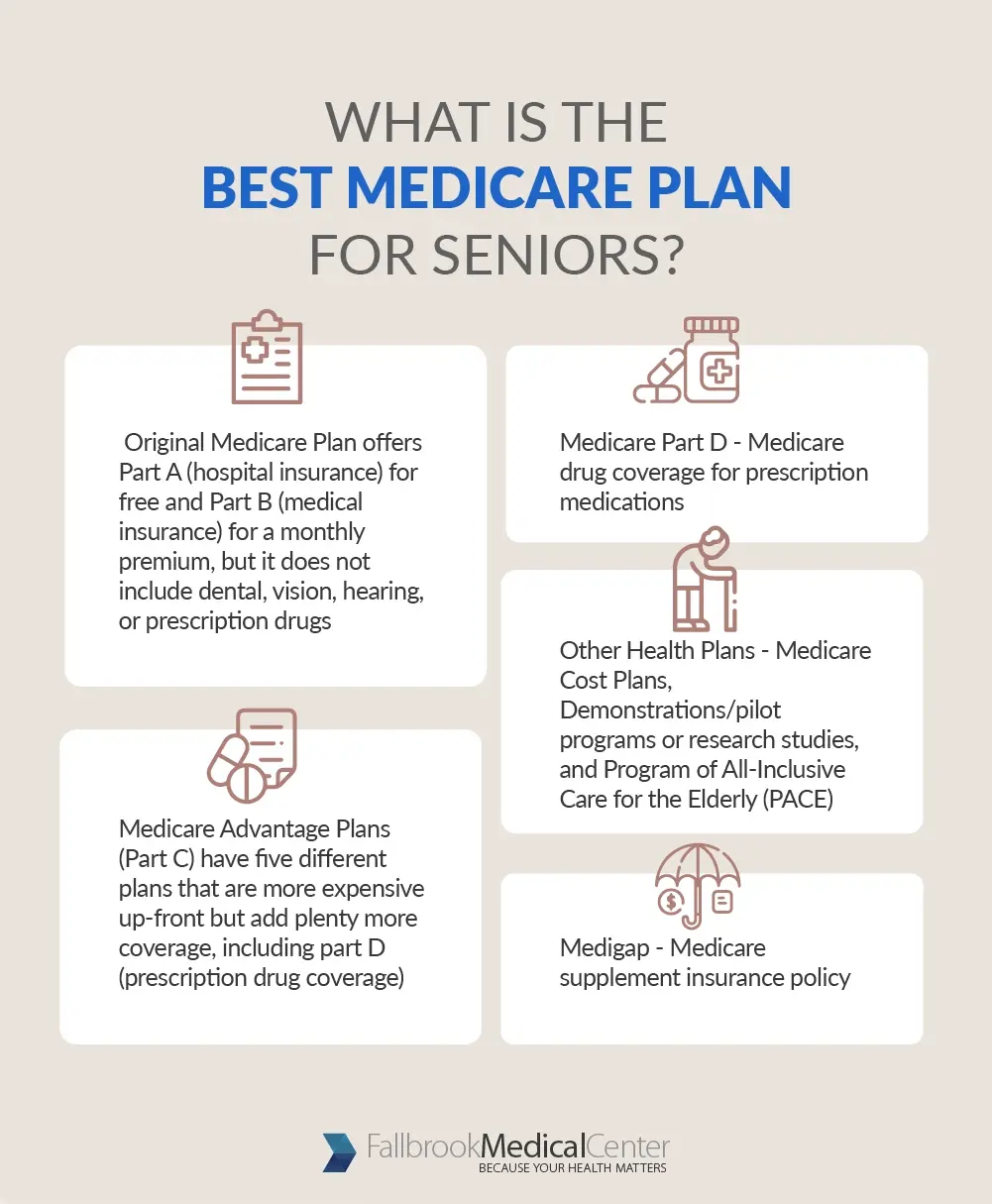

You can: Call the plan you want to leave and ask for a disenrollment form; or Call 1-800-MEDICARE (1-800-633-4227) to demand that your disenrollment be processed over the phone; or Call the Social Safety Administration or visit your Social Security Workplace to submit your disenrollment request. The telephone number for the Social Safety and security office in your area can be located in the Important Phone Figures section of this site.There are some Medicare Wellness Strategies that cover prescription medicines. You can additionally inspect into obtaining a Medigap or extra insurance policy for prescription medicine protection.

The Definitive Guide for Medicare Graham

Medigap plans are personal wellness insurance policies that cover some of the expenses the Initial Medicare Strategy does not cover. Some Medigap plans will certainly cover services not covered by Medicare such as prescription medications.

Your State Insurance Department can respond to questions concerning the Medigap plans sold in your area. Check the Important Phone Figures area of this internet site for the contact number of your State Insurance Division. If you have actually operated at least ten years in Medicare covered employment you will receive exceptional free Medicare Part A (Medical Facility Insurance).

Fascination About Medicare Graham

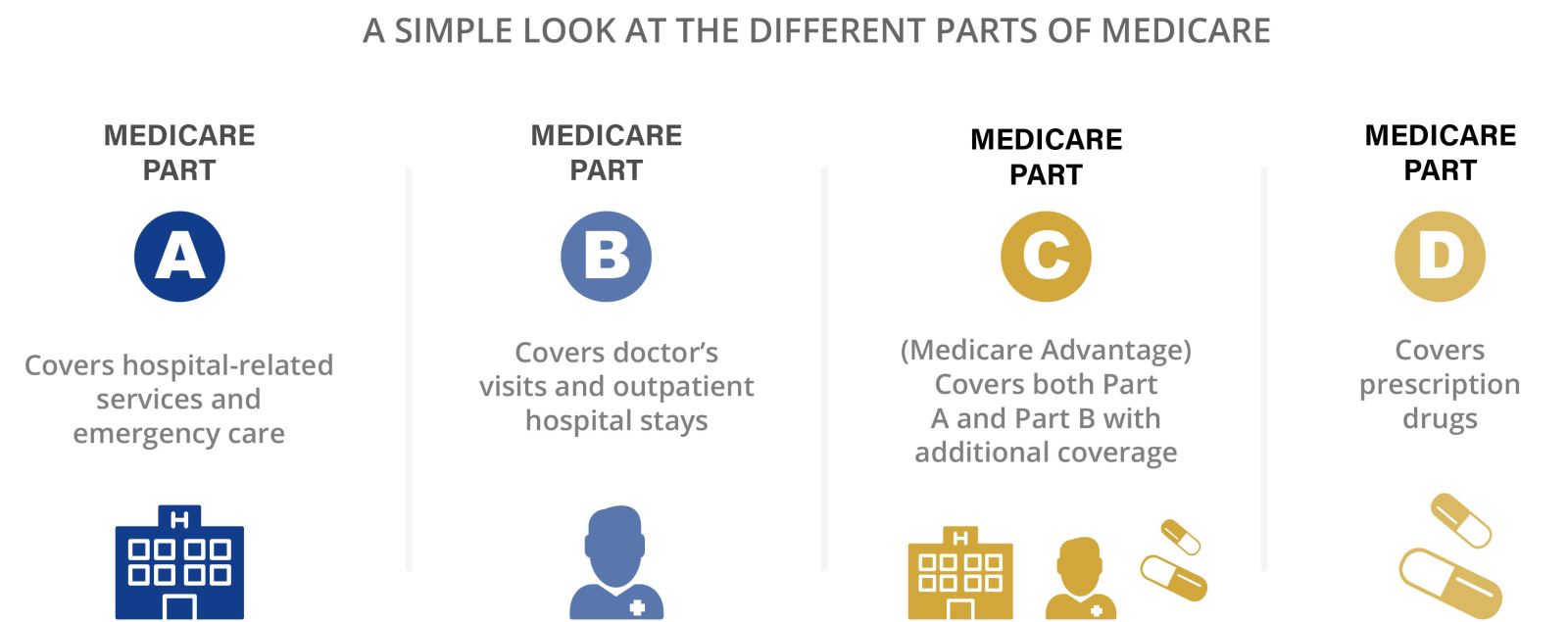

Check the Important Phone Figures section of this internet site for the contact number of the Social Safety And Security Workplace in your location. Medicare Component B helps spend for physicians' solutions, outpatient hospital care, blood, clinical devices and some home wellness services. It additionally spends for other medical services such as laboratory tests and physical and occupational treatment.

The Best Guide To Medicare Graham

Some frequency restrictions may use. Medicare does not cover insulin and syringes. Get In Touch With your Sturdy Medical Equipment Regional copyright for more details. Inspect the Important Phone Numbers section of this internet site for the phone number. An insurance deductible is the amount you need to pay yearly prior to Medicare starts paying its part of your clinical costs.

Your deductible is taken out of your cases when Medicare receives them. Medicare handled care plans are one more way for you to get Medicare benefits.

There are four components of Medicare: Component A, Component B, Part C, and Component D. Generally, the 4 Medicare parts cover different services, so it's important that you recognize the alternatives so you can choose your Medicare insurance coverage very carefully. Possibly you're obtaining close to the age of 65 or simply intend to comprehend how Medicare works so you can aid a member of the family or buddy.

Whatever your situation, you come to be qualified for Medicare when you reach 65. If you currently obtain Social Safety and security, you'll be enlisted in Medicare instantly the month you turn 65. The card will get here in the mail. In enhancement, you are automatically registered in Medicare Components A and B if you are disabled and have received disability repayments from Social Safety and security for 24 months.

Indicators on Medicare Graham You Should Know

Medicare Component A covers the costs of hospitalization. This includes inpatient care at a health center, proficient nursing facilities, hospice care, and home healthcare. For lots of people, there is no monthly expense for Part A if you or your partner paid Medicare taxes for a minimum of one decade. If you didn't pay sufficient into Medicare, the premium for Part A in 2025 is either $285 or $518 per month, up from $278 or $505 in 2024 - Medicare.

At that factor, you pay $0 for the first 60 days of protection. Co-payments look for stays past 60 days and you spend for the entirety of your medical facility remain after 150 days. Medicare Part A covers hospice care at an inpatient center, it should be organized with a Medicare-approved hospice copyright.

The smart Trick of Medicare Graham That Nobody is Talking About

Kathryn B. Hauer, a financial expert at Wilson David Investment Advisors and the author of Financial Guidance for Blue Collar America, alerts that ruining diseases such as cancer can ravage your financial resources in retirement and prompts Medicare receivers to take into consideration extra coverage. She notes that Medicare users without Medigap insurance coverage spend 25% to 64% of their earnings on clinical costs.

Some Ideas on Medicare Graham You Should Know

(https://slides.com/m3dc4regrham)Medicare will certainly cover acute-care hospital services for people who are moved from an extensive care or essential treatment unit. Depending on your plan, you may need to pay an annual insurance deductible prior to qualified medication expenses are covered, and some Part D strategies have a co-pay.

Report this page